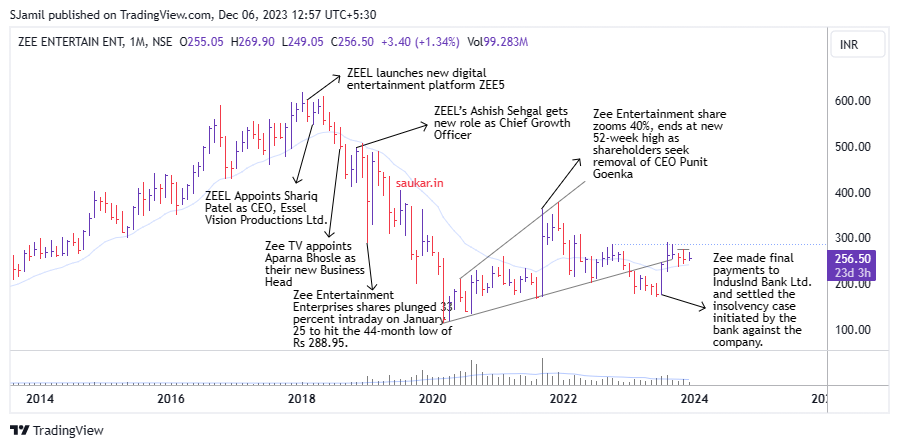

The narrative unfolded in early 2018 with the introduction of ZEE5, a new digital entertainment platform by ZEEL. Subsequently, the stock prices experienced a persistent downturn. This trend was exacerbated by a series of managerial changes and news of stake sell-offs, culminating in the stock reaching a low point of 114 in March 2020. Despite subsequent attempts at recovery, it appears to be more of a temporary pause. The stock then entered a consolidation phase, taking the form of an ascending broadening wedge formation.

The pivotal point now rests at the 290 level, serving as a decisive factor in determining the future trajectory of ZEEL’s stock prices. Should it manage to surpass and sustain trading above this level for a few months, it could signify the emergence of a new trend for ZEEL. Meanwhile, the CNX Media index exhibits strength on one side, underscoring the critical juncture at which ZEEL finds itself.

Leave a Reply