Smallcases are a fresh approach to investing in stocks. Basically, a smallcase is a carefully selected group of up to 50 stocks that are weighted in a smart way. Each smallcase is designed to represent a specific theme, idea, or investment strategy. Instead of buying individual stocks, you can invest in a smallcase to gain exposure to multiple stocks that revolve around a particular concept or trend.

Bengaluru-based smallcase Technologies is paving the way for modern investors allowing them to choose from professionally tailored baskets of stocks that reflect an investing idea or strategy.

Currently, seven brokers have a collaboration with the company and are offering this platform. They include Kotak Securities, HDFC Securities, 5paisa, Edelweiss, Zerodha and Axis Securities.

How does smallcase work?

Smallcase account allows an investor to buy and sell tradable securities based on the predefined combinations.

To use the platform, follow these steps:

To begin, visit the smallcase website and locate the login option. In order to log in, you will need to use the credentials provided by your specific broker. It is important to note that if you have a broker other than the one specified, you might not be able to access the services.

After successfully logging in, you will be presented with a variety of themes to choose from. These themes include options like all-weather, smart beta, bargain buys, and many others.

Once you’re logged in, you’ll be able to see the stocks in the portfolio, how much of each stock is included, and why they were chosen. You can even customize the smallcase by adding or removing stocks to make it fit your preferences.

It is important to note that different brokers have varying capabilities. Some brokers provide the option to create personalized smallcases, allowing you to curate your own portfolio. On the other hand, certain brokers offer pre-curated smallcases that have been carefully selected by experts.

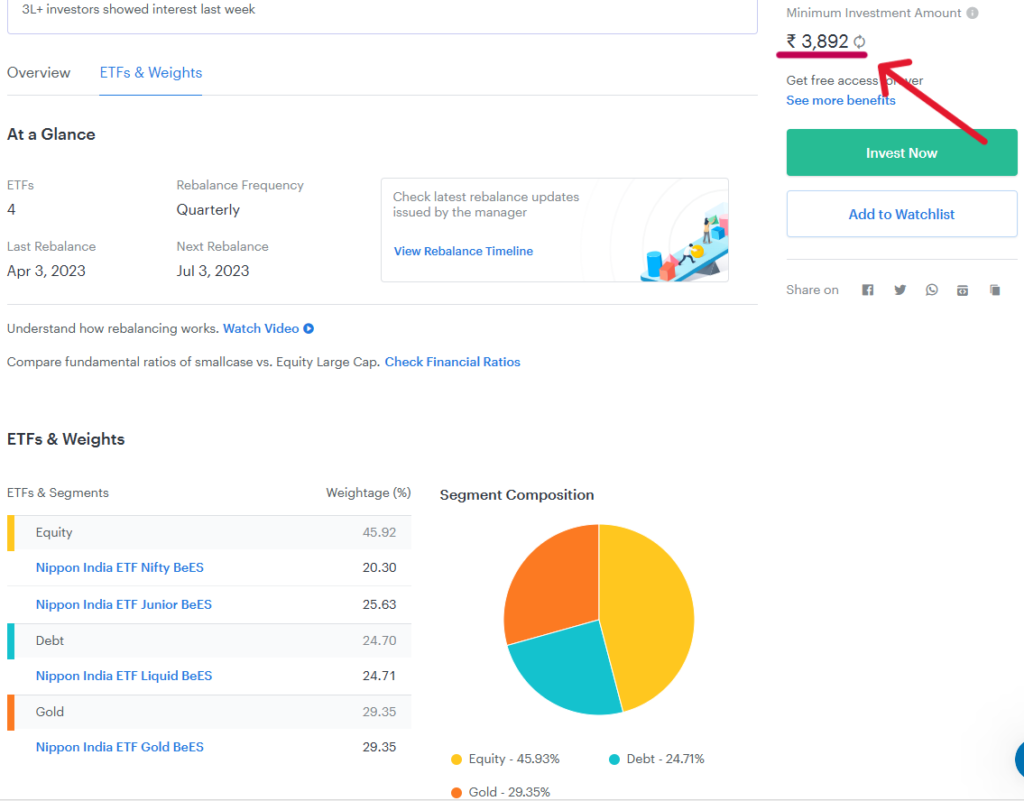

For example, in this smallcase, titled All Weather Investing, Equity, debt and gold ETF have been selected. Source: smallcase.com

After finalizing your smallcase selection, you will be directed to the payment gateway. The price and weight of each individual stock will determine the minimum amount you need to pay for the smallcase. For example, in the above mentioned scenario, the minimum amount is Rs 3,892.

Once your payment is successfully processed, your broker’s platform will proceed to place buy orders for all the stocks in the smallcase. These orders will be executed immediately based on the availability of liquidity in the market.

However, in case there is a lack of liquidity resulting in the non-fulfillment of some orders, you will have the option to “repair” your order. This means you can go back and make necessary adjustments to ensure that the portfolio remains in line with the original theme. You can do this either immediately or at a later time, and once the order is repaired, a fresh order will be placed to match the desired portfolio.

Regarding the charges, for smallcases like All Weather Investing and Smart Beta, the fee is Rs 50 plus GST. For all other smallcases such as thematic, sectoral, model-based, equity, and gold smallcases, the fee is Rs 100 plus GST. These fees are one-time charges for each smallcase.

However, it’s important to note that for subsequent orders within the same smallcase, no additional charges will be applicable.

In addition to the smallcase fees, regular brokerage charges and other fees associated with buying and selling stocks will be deducted for every order. These charges are separate and will depend on your broker’s specific terms and conditions.

Caution: It should be noted that the smallcase platform may not be suitable for a first time or new investor, as he or she may not be qualified enough to understand the risks associated with the product. It is advisable to consult a financial advisor before investing via this product.

Leave a Reply