Nicholas Daras is a well-known trader who has made a name for himself in the financial world. His innovative trading strategies and impressive track record have captured the attention of both experienced traders and aspiring investors. In this blog post, we will explore the life and trading strategy of Nicholas Daras, shedding light on his approach to the financial markets and the factors that have contributed to his extraordinary success.

Who is Nicholas Darvas?

Nicholas Darvas is a highly accomplished trader and entrepreneur. He grew up in New York City and has always had a strong interest in finance. With his passion and determination, he has become one of the most influential figures in the trading community.

Darvas documented his techniques in the book, How I Made 2,000,000 in the Stock Market. The book describes his unique “Box System”, which he used to buy and sell stocks. Darvas’ book remains a classic stock market text to this day.

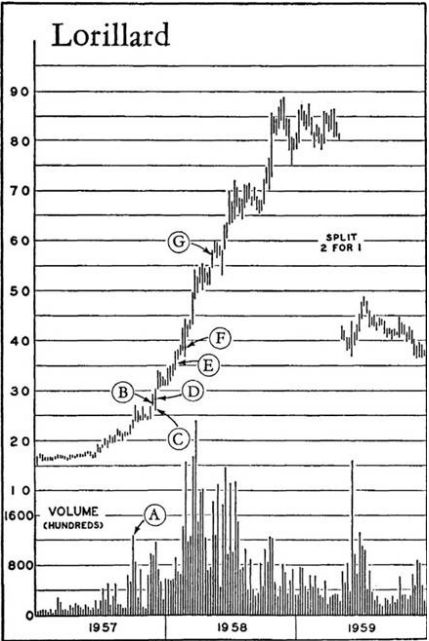

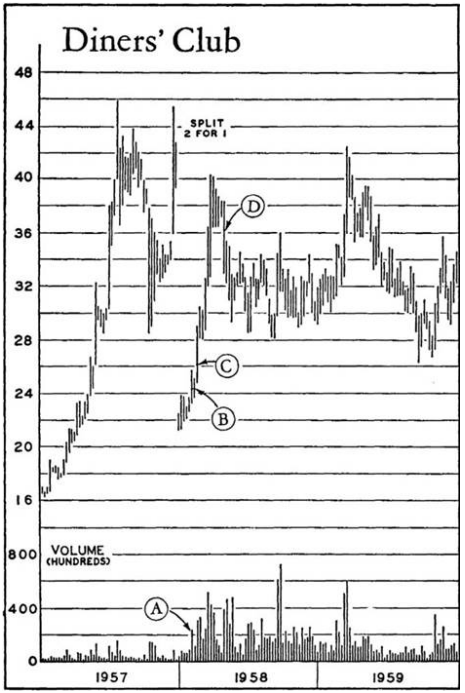

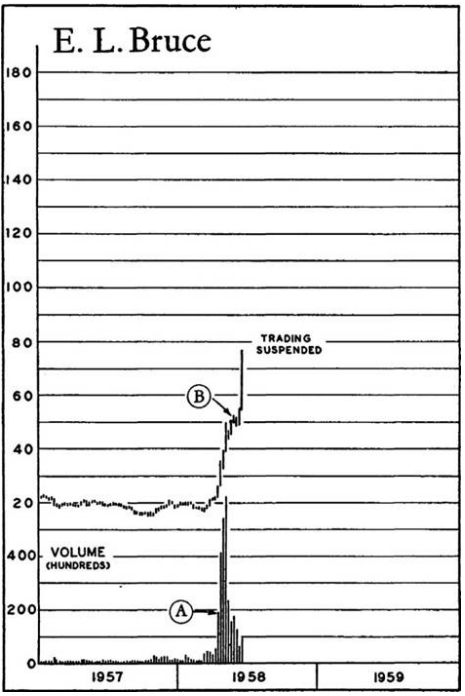

The following charts presents information about the prices and trading volumes of major stocks. These stocks helped Nicolas Darvas make a significant $2,000,000. It took him a little over 18 months to achieve this impressive result. We have included records from a three-year period, covering 1957 to 1959, to show how the stocks moved before, during, and after Darvas held them.

We have also added explanations to help you understand why Darvas chose each stock, when he bought them, and how he used a trailing stop-loss strategy. This strategy is based on Darvas’ techno-fundamentalist theory, which you can read about in the book. To make it easier for you to follow Darvas’ transactions, we have arranged the charts in the same order as the stocks are discussed in the book. This way, you can see the sequence of his actions as they happened.

LORILLARD

Darvas noticed a significant increase in trading volume (A) and began monitoring the stock daily. He purchased 200 shares of LORILLARD at 27½ (B) but sold them quickly when the price dropped (C) and hit his stop-loss at 26. Convinced by the subsequent rise, he bought 200 shares again at 28¾ (D). As the stock continued to climb, Darvas bought an additional 400 shares at 35 and 36½ (E), and it reached a new high of 44⅜.

A sudden drop to 36¾ (F) prompted Darvas to raise his stop-loss to 36, but it wasn’t triggered. He bought a final lot of 400 shares at 38⅝. Despite the temptation to sell for a quick profit, Darvas followed his principle of not selling a rising stock and trailed his stop-loss at a safe distance behind the rising price. There was a brief drop to 53⅜ in June, which could have resulted in a sale if his stop-loss had been closer. However, Darvas could have continued with LORILLARD’s remarkable rise into the 80s by the end of the year.

In May, Darvas became interested in another stock and needed the capital, so he sold his 1,000 shares of LORILLARD at 57⅜ (G) for a substantial profit of $21,000. He was now prepared to invest in E. L. BRUCE.

DINERS’ CLUB

DINERS’ CLUB initially showed a rising price trend in the first half of 1957, but without a significant increase in volume. However, after a 2-for-1 stock split, there was a sudden surge in volume at (A) that caught Darvas’ attention. He discovered that DINERS’ CLUB was a pioneer in a promising new industry with a positive earning trend.

Confident in the fundamental aspect, Darvas bought 500 shares at 24½ (B) and added another 500 shares at 26 1/8 shortly after (C) as the stock continued to climb. He observed the formation of “pyramiding boxes” and a substantial increase in trading volume. As the price rose, Darvas raised his stop-loss from 27 to 31.

However, when the stock reached a new high of 40½, Darvas felt uncertain about its future trajectory. He sensed a potential reversal and decided to move up his stop-loss to 36⅝. In late April, Darvas’ concerns materialized as DINERS’ CLUB experienced a significant drop, and he was sold out at (D) with a profit of over $10,000.

Interestingly, at the time, Darvas made his decision based solely on technical factors, unaware that American Express was about to enter the credit-card market, directly competing with DINERS’ CLUB. The successful timing of his exit confirmed the validity of his technical approach.

E.L.BRUCE

While invested in LORILLARD and DINERS’ CLUB, Darvas noticed a significant interest in a stock called E. L. BRUCE (A). Although it didn’t meet his fundamental criteria, the technical pattern was compelling. After a remarkable rise from 18 to 50, followed by a temporary drop to 43½, Darvas saw it as a refueling phase rather than a reversal. Despite the lack of fundamentals, he decided to sell out of LORILLARD to have all his funds available for immediate investment in BRUCE.

Within three weeks at the end of March, Darvas purchased 2,500 shares of BRUCE at an average price of 52 (B). His timing was perfect, as BRUCE started climbing rapidly, drawing attention worldwide. The situation was extraordinary, with short-sellers scrambling to cover their positions and trading being suspended on the Exchange. However, Darvas made a momentous decision not to sell this advancing stock. A few weeks later, he sold his BRUCE shares for an average price of 171, resulting in a profit of $295,000.

FAIRCHILD CAMERA

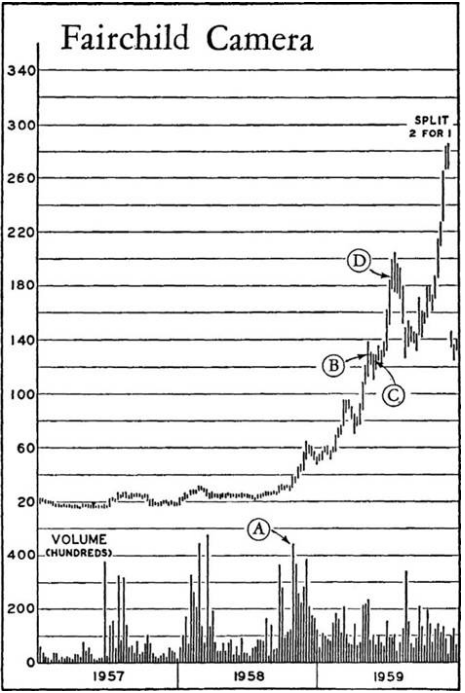

After selling THIOKOL, Nicolas Darvas had over $1,000,000 in investment capital. He decided to divide this amount into two parts and narrowed down his choices to four stocks that aligned with his techno-fundamentalist theory. FAIRCHILD CAMERA was one of the stocks that passed a test buy to assess their relative market strength.

FAIRCHILD CAMERA had exhibited price stability throughout 1957 and most of 1958, despite two periods of significant increases in trading volume. However, towards the end of 1958, there was a new surge in volume (A), accompanied by a rapid and continuous rise in the stock’s price, catching Darvas’ interest.

He made an initial purchase of 500 shares at 128 (B) when the stock had established itself within a price range of 110/140. Darvas removed his arbitrary 10% stop-loss, which was too close to the lower limit of the price range. This decision proved beneficial as the stock experienced a low of 110¼ two weeks later. Instead of being affected, Darvas saw the stock regain its upward momentum quickly and proceeded to buy an additional 4,000 shares at (C), with prices ranging from 123¼ to 127.FAIRCHILD CAMERA closed at 185 (D).

Leave a Reply