Introduction:

When it comes to investing in equity markets, many individuals are intrigued by the concept of Systematic Investment Plan (SIP). SIP offers a disciplined approach to investing in mutual funds, allowing individuals to invest a fixed amount at regular intervals. This article aims to shed light on what SIP in equity entails, how it works, and the ideal duration for SIP investments.

What is SIP in Equity?

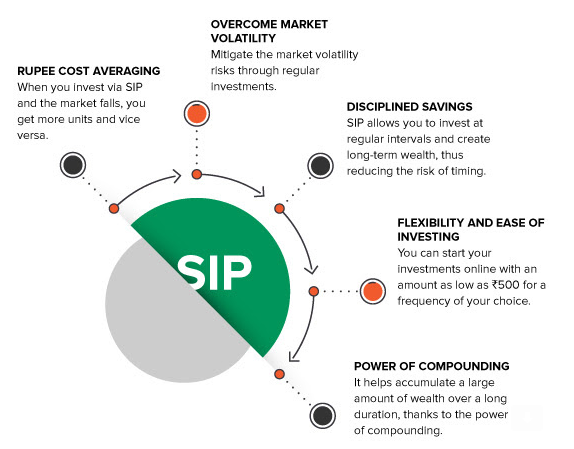

Systematic Investment Plan, commonly known as SIP, is an investment strategy in which investors regularly invest a fixed amount in a mutual fund scheme over a specific period. In the context of equity, SIP allows individuals to invest systematically in equity-oriented mutual funds. The primary objective of SIP in equity is to accumulate wealth over the long term by taking advantage of the power of compounding and rupee-cost averaging.

How Does SIP Work?

SIP functions on a simple yet powerful principle: regular investment of a fixed amount. Here’s how SIP works:

- Choose a Mutual Fund: Select a mutual fund scheme that aligns with your financial goals, risk appetite, and investment horizon. Equity-oriented funds are generally suitable for long-term wealth creation.

- Determine Investment Amount: Decide on the amount you want to invest periodically. The minimum investment amount for SIPs is typically low, making it accessible to a wide range of investors.

- Select the Frequency: SIPs offer flexibility in terms of investment frequency. You can choose to invest monthly, quarterly, or even weekly, depending on your convenience.

- Automate Investments: Set up an auto-debit facility with your bank account to ensure that the predetermined investment amount is deducted automatically and invested in the chosen mutual fund scheme.

- Rupee-Cost Averaging: SIPs capitalize on the market volatility. When the markets are down, the fixed investment amount fetches more units, and when the markets are up, the same amount fetches fewer units. This strategy is known as rupee-cost averaging, which helps in reducing the impact of market fluctuations.

- Power of Compounding: By investing regularly over an extended period, SIP investors benefit from the power of compounding. The earlier you start and the longer you stay invested, the greater the potential for wealth accumulation.

For How Many Years Can One Do SIP?

SIP duration primarily depends on individual financial goals and investment objectives. Ideally, one can continue with SIP investments for as long as they have a long-term financial horizon. Here are a few key considerations:

- Financial Goals: Determine the duration required to achieve your financial goals. Whether it’s retirement planning, wealth creation for your child’s education, or buying a house, identify the time horizon and adjust your SIP accordingly.

- Investment Horizon: SIPs work best when investments are made for the long term. Equity investments tend to be volatile in the short term, and staying invested for a longer duration helps mitigate the impact of market fluctuations.

- Review Periodically: Regularly review your SIP investments to ensure they are aligned with your evolving financial goals. As your goals change, you may need to adjust the investment duration or redirect funds to different asset classes.

Remember, SIPs offer flexibility, and investors have the freedom to start, stop, increase, or decrease the investment amount as per their financial circumstances. SIPs are not restricted by a specific time frame, and one can continue investing for as long as it aligns with their financial objectives.

Conclusion:

Systematic Investment Plan (SIP) in equity is a popular investment strategy that allows individuals to invest a fixed amount regularly in equity-oriented mutual funds. SIPs leverage the power of compounding and rupee-cost averaging to accumulate wealth over the long term. While the duration of SIP investments depends on individual financial goals and investment horizons, the longer one stays invested, the better the potential for wealth creation. By adopting a disciplined and systematic approach, investors can benefit from the advantages offered by SIPs and work towards achieving their financial aspirations.

Leave a Reply