In a recent development, Emkay Global Financial Services, a brokerage firm, has started covering Britannia stock and recommended a ‘buy’ rating. They have set a target price of ₹5,700, which is based on a price-to-earnings ratio (PER) of 50 times. This valuation represents a premium of about 20 percent compared to Britannia’s average forward PER over the last 10 years.

Emkay justifies this premium valuation by pointing out the company’s improved execution and positive outlook on adjacencies. They believe that Britannia is strongly positioned in the core biscuits segment and is actively addressing gaps in adjacent areas. The brokerage firm sees potential for Britannia to transform into a comprehensive food company, expanding beyond its current focus.

Prior to February 15th, there was a consolidation phase taking shape in the stock chart of Britannia. This consolidation occurred after a significant breakout from a broadening wedge pattern. While there was a missed opportunity for a pocket pivot entry at 3950, entering the stock at 4390 was still a favorable decision.

Stock is little extended from base and not buyable at the moment.

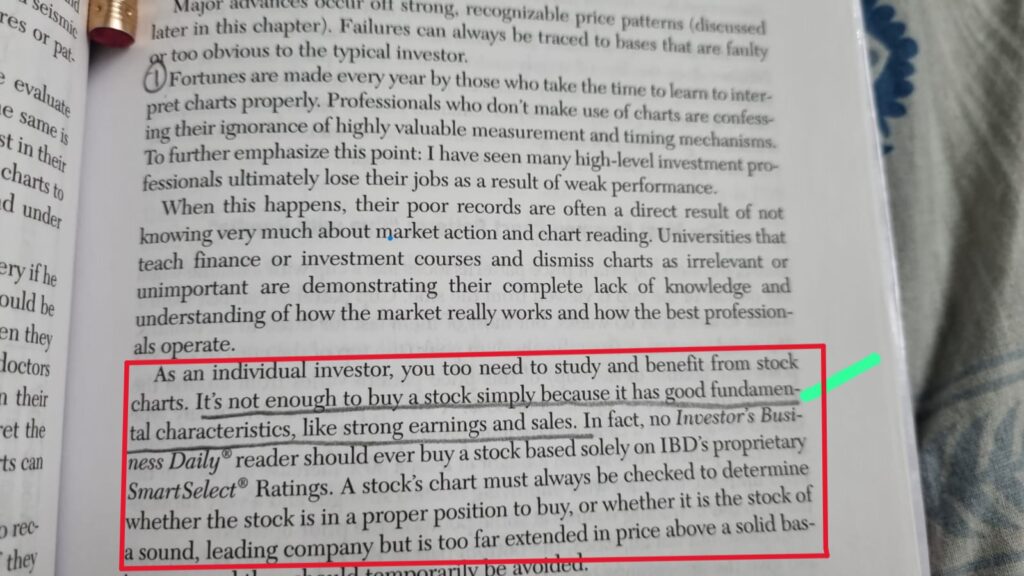

The example mentioned about Britannia stock aligns with the advice given by William O’Neil in his book. According to O’Neil’s principles, it is generally not recommended to buy stocks that are significantly extended in price above a strong base.

One of my new student recently shared a screenshot with me.

Leave a Reply