Certainly! You can generate and distribute your “smallcase portfolio” among your loved ones and acquaintances.

Creating and Sharing a Winning smallcase

A smallcase is a collection of different stocks or ETFs based on a specific investment idea. Creating and sharing a winning smallcase not only helps you grow your money but also lets you share your investment knowledge.

In this blog post, we’ll explain how to create and share a winning smallcase in simple steps.

Choose Your Investment Idea:

Start by picking an investment idea that excites you. It could be about a specific industry, a trend in the market, or a strategy you believe in. Do some research, study market trends, and find opportunities that match your investment goals and how much risk you’re willing to take. Choose an idea that you understand well and feel confident about.

Do Your Research:

Once you have your investment idea, it’s time to dig deeper. Research different stocks or ETFs that fit your strategy. Look for companies with strong fundamentals, good growth potential, and a history of performing well in the industry you’re interested in. Check financial information, industry trends, competition, and any other factors that could affect the smallcase’s performance.

Decide on Your Portfolio:

Based on your research, decide how much of your money you want to allocate to each stock or ETF in your smallcase. Think about factors like the size of the companies, their risk and return potential, and how they relate to each other. It’s important to have a balanced mix that reduces the chance of big losses while aiming for good returns.

Keep an Eye on Your Investments:

Creating a winning smallcase doesn’t stop after you’ve made your initial choices. Keep an eye on your investments regularly. Stay updated with the latest news and market trends that could affect your smallcase. Make adjustments from time to time to keep your portfolio balanced and take advantage of new opportunities.

Track Performance and Learn from Feedback:

Once your smallcase is out there, keep track of how it’s performing. Compare its returns to relevant benchmarks and see how it’s doing compared to your expectations. Listen to feedback from others and use it to improve your smallcase over time.

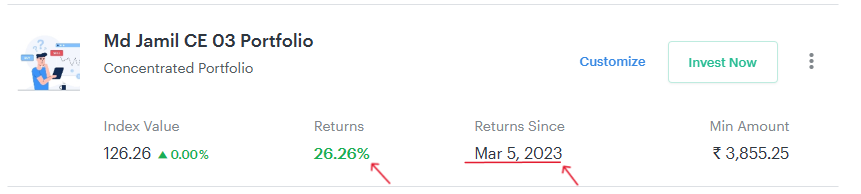

On March 5th, 2023, I created a small portfolio for a select group of my friends, utilizing a momentum strategy. Specifically, I focused on stocks that were trading close to their 52-week high levels. This small portfolio was highly concentrated, consisting of just three carefully chosen stocks.That portfolio till date has given a 26% profit returns.

The three stocks included in the concentrated portfolio were:

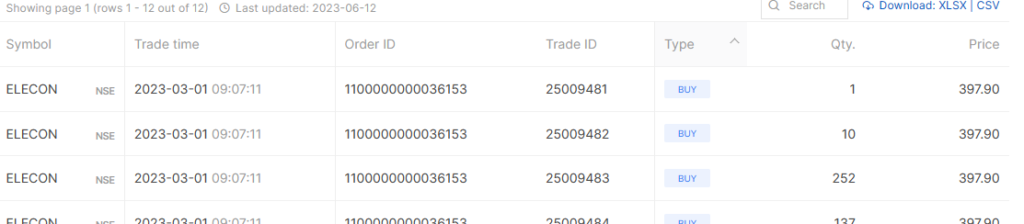

Elecon Engineering: Elecon, one of the stocks in the concentrated portfolio, has experienced a significant rally, with its value increasing by nearly 40% from the purchase level. As a result, we decided to capitalize on this gain by booking partial profits.

The red arrow in the chart below indicates the purchase price level of the stock.

Tvs Motor: I also conducted an analysis of this stock on YouTube.

Indraprastha Gas (IGL): I analyzed the stock IGL on my blog in the past.

We maintain a consistent practice of creating and managing small portfolios for our family and friends who have a good understanding of the risks associated with equity investments. We invite you to become a part of our community by opening a demat account with us. This will allow you to actively participate in our investment activities and benefit from the opportunities we identify.

Leave a Reply