Dow Theory is a fundamental concept in technical analysis that was developed by Charles H. Dow, one of the founders of Dow Jones & Company and the Wall Street Journal. Dow Theory provides a framework for understanding and analyzing price movements in financial markets, particularly in the context of stock market trends. While the theory was developed in the late 19th and early 20th centuries, its principles continue to be influential in modern technical analysis.

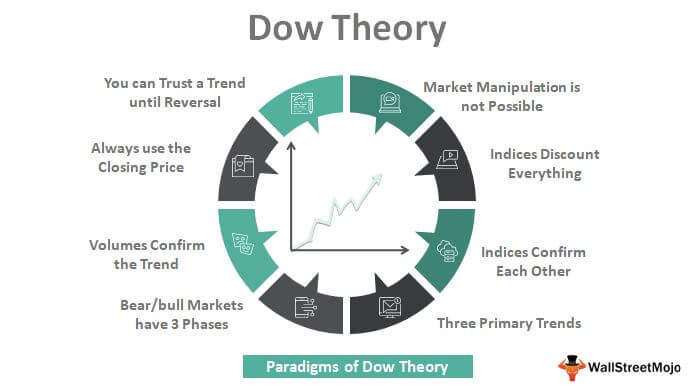

Key principles of Dow Theory include:

- The Market Discounts Everything: This principle suggests that all known information, whether it be economic, political, or psychological, is already reflected in market prices. In other words, market prices instantly incorporate and reflect any news or information that may affect them.

- There Are Three Types of Trends:

- Primary Trend: This is the main, long-term trend that reflects the overall direction of the market. It can last for several months to years.

- Secondary Trend (Reaction): This is a shorter-term movement that goes against the primary trend. It is considered a correction within the primary trend.

- Minor Trend (Daily Fluctuations): These are short-term fluctuations that occur within the secondary trend. They are usually brief and have less significance.

- Trends Have Three Phases:

- Accumulation (or Mark-Up): Smart money (informed investors) begins to buy or sell, causing a gradual change in the direction of the market.

- Public Participation (or Public Participation): The trend gains momentum as the general public and institutional investors join in, driving prices further in the direction of the trend.

- Distribution (or Mark-Down): Smart money starts to exit, and the trend reverses.

- The Averages Must Confirm Each Other: Dow Theory was originally applied to the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). According to Dow, for a true trend reversal to be confirmed, both averages should move in the same direction. If one average makes a new high (or low), the other should ideally do the same to confirm the strength of the trend.

- Volume Should Confirm the Trend: Dow Theory also considers trading volume. In a healthy trend, volume should increase in the direction of the trend. For example, during an uptrend, higher trading volumes should accompany rising prices, and during a downtrend, higher volumes should accompany falling prices.

Leave a Reply