In the world of stock market analysis, traders and investors are always on the lookout for reliable patterns that can help them identify potential buying opportunities. One such pattern, popularized by legendary investor William O’Neil, is the “Cup with Handle” pattern. This pattern has been widely used by investors to identify stocks with the potential for significant price appreciation. In this blog post, we will dive into the details of the Cup with Handle pattern, its construction, and how it can be used to make informed investment decisions.

Understanding the Cup with Handle Pattern:

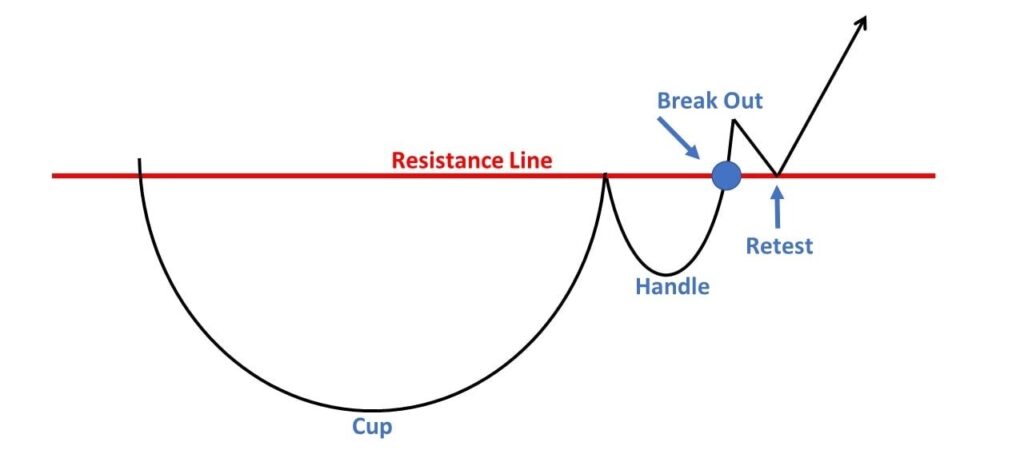

The Cup with Handle pattern is a bullish continuation pattern typically observed during an uptrend in a stock’s price. It is characterized by a cup-like shape followed by a consolidation period known as the handle. This pattern indicates a temporary pause in the upward movement before the stock resumes its upward trajectory.

Construction of the Pattern:

The formation of the Cup with Handle pattern involves several key elements. Let’s examine the pattern’s construction:

Cup Formation: The cup formation represents the initial phase of the pattern and resembles a rounded bottom. It is formed by a gradual decline in the stock’s price, followed by a gradual rise to complete the cup shape. The duration of the cup formation may vary, typically spanning several weeks to months.

Cup Depth and Duration: The depth of the cup is an important consideration. A deeper and more rounded cup suggests a significant price correction before the stock resumes its upward movement. The duration of the cup should also be taken into account, as longer cup formations tend to be more reliable.

Handle Formation: After the completion of the cup formation, a smaller consolidation period known as the handle is formed. The handle is characterized by a slight downward drift in the stock’s price, usually lasting for one to four weeks. The handle should be relatively shallow, with the stock’s price retracing no more than one-third of the cup’s depth.

Volume Analysis: Throughout the formation of the pattern, volume plays a crucial role. During the cup formation, trading volume tends to be higher during the decline and lower during the recovery. During the handle formation, volume should diminish, indicating a decrease in selling pressure.

Interpreting the Cup with Handle Pattern:

Once the Cup with Handle pattern is formed, it provides valuable insights for investors. Here’s how to interpret the pattern:

Breakout: The pattern is considered complete when the stock’s price breaks out above the handle’s high point, confirming a bullish signal. This breakout should ideally be accompanied by above-average trading volume, indicating strong buying interest.

Entry Point: The ideal entry point for a trade is just above the handle’s high point, providing confirmation of the breakout. Investors can set a stop-loss order just below the handle’s low point to manage potential downside risk.

Price Target: To estimate the price target, measure the depth of the cup from the cup’s high point to the cup’s low point and add it to the breakout level. This projected target can serve as a potential exit point for the trade.

Confirmation Indicators: Traders can further strengthen their conviction in the pattern by considering additional indicators, such as positive earnings growth, strong industry fundamentals, and positive market conditions.

The Cup with Handle pattern, popularized by William O’Neil, is a powerful tool that can help investors identify potential buying opportunities in the stock market. By recognizing the cup formation, analyzing the handle, and interpreting the breakout, traders can gain a competitive edge and increase their chances of capturing significant price appreciation. It is important to note that while the Cup with Handle pattern.

The price of Innovators Facade System has experienced a significant surge following the successful completion of a cup and handle breakout and subsequent retest.

Leave a Reply