Gujarat Mineral Development Corporation, incorporated in the year 1963, is a Small Cap company (having a market cap of Rs 4315.26 Crore) operating in Mining sector.

Gujarat Mineral Development Corporation key Products/Revenue Segments include Lignite, Thermal Power, Renewable Energy System, Interest, Bauxite

Management’s focus is to diversify the revenue base of the company from lignite and so the company plans to foray into manufacturing of rare-earth elements, and non-lignite businesses such as silica sand, Fluorspar, multi metal, and limestone for which it has roped in BCG for feasibility study. In the coming years, it aims to earn at least ~50% revenue from the non-lignite portfolio. This will help the company to mitigate the risk of dependence on a single commodity and also improve the ESG rating of company.

The company is planning to develop 6 new mines over next 1.5-2 years to ensure that production stays above 10 million tons per annum (mtpa). Further, there is a distinct focus on value added products in Bauxite and other minerals. (Courtesy: HDFC Sec)

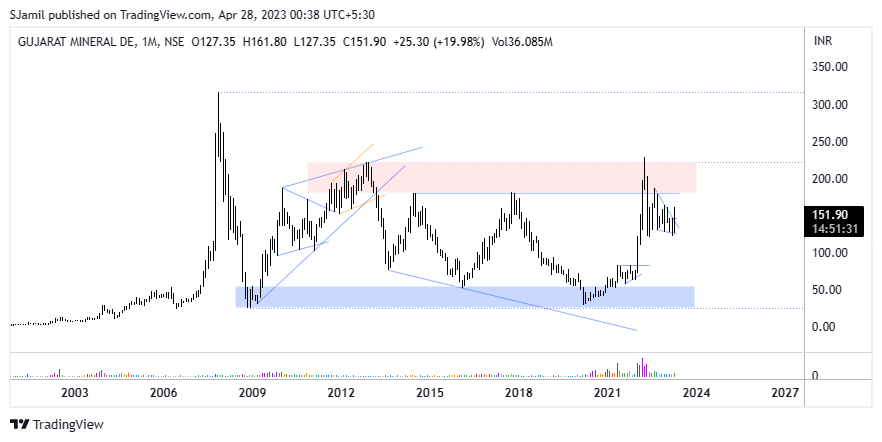

A huge range of 200 Rs over 15 years, isn’t it interesting?

This PSU is coiling in between two zones (blue-demand and red-supply zone). Now it is third time stock tried to penetrate through supply but couldn’t. But prices are showing some positive accumulation below supply zone, which is an early sign of strength.

One should monitor this chart closely which may offer good risk reward if tears supply zone.

Leave a Reply