The Government of India has accepted several key recommendations made by the Kirit Parikh Committee with respect to the pricing of natural gas produced from the APM fields.

The government’s new pricing regime for domestic natural gas is likely to be positive for city gas distributors (CGDs) in the near-term, according to Kotak Institutional Equities.

According to analysts at ICICI Securities, the step would ease pressure on city gas distribution companies (CGDs) as their margins were impacted by earlier sharp rise in domestic gas prices. The move is more positive for Indraprastha Gas (IGL) and Mahanagar Gas (MGL) as their segmental revenues are dominated by CNG and domestic PNG volumes, which are prioritized for the use of APM gas. The cash flow certainty for these companies would also improve, going ahead.

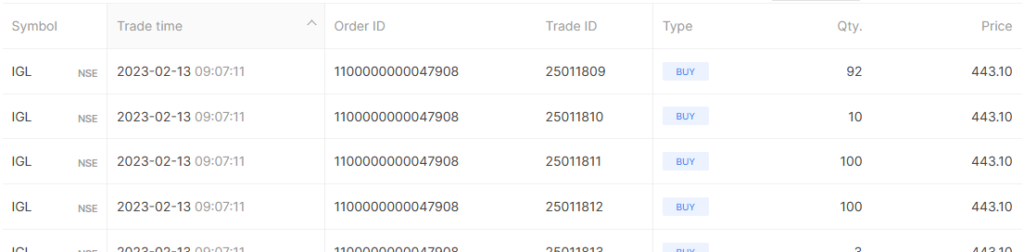

Bought IGL on pocket pivot breakout level at 443. Stock prices are on verge of breakout from 30-week long base. IGL is now trading at 468 level.

Leave a Reply